|

Getting your Trinity Audio player ready...

|

By Alric Lindsay

A leaked report of the Office of the Auditor General on the Integrated Solid Waste Management System for the Cayman Islands (Regen) contains disturbing conclusions about the Government’s handling of aspects of Regen. Some of these findings for the period under review to 2021 were the Government failed to properly record the public-private partnership with the DECCO consortium as a form of borrowing, did not show how Regen would provide value for money, did not perform due diligence checks on changes in consortium members, did not prepare a final business case, assumed most of the risks associated with Regen and allegedly did not comply with the Framework for Fiscal Responsibility agreed with the United Kingdom.

Background / The DECCO consortium

For those who are not familiar with the Regen project, the Auditor General’s report explained:

The Government first set out its policy for this waste disposal system in 2013.

The Government selected Waste Solutions Cayman Ltd. (the “Contractor”) as Regen’s preferred bidder in September 2017.

Reportedly, the Government “took almost four years before the Government signed a contract with the Contractor in March 2021,” just one month before the general elections.

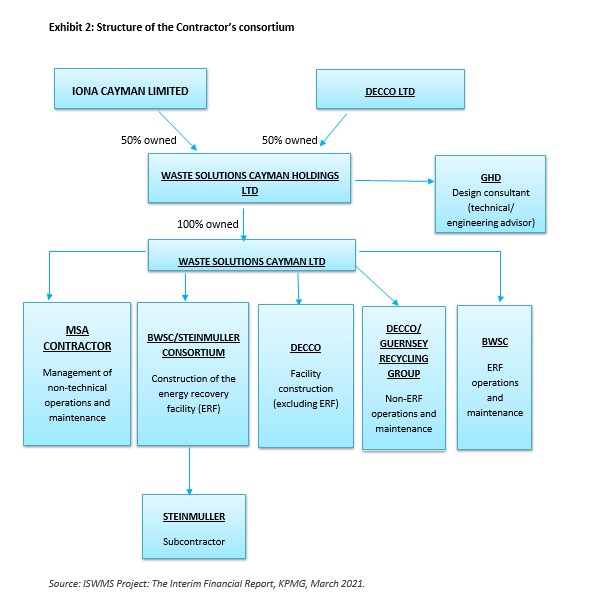

The Contractor was established as a special-purpose vehicle for a consortium of companies that bid for the project.

Members of the consortium, “owned by Decco Ltd and Iona Cayman Ltd.” were as follows:

Issue 1: Flaws in business case and failure to properly record the public-private partnership (PPP) as borrowing

Concerning the structure and public-private partnership (PPP) with the Government, the Auditor General found that the “Outline Business Case (OBC) for the project… was fundamentally flawed because the Government erroneously concluded that a PPP was not a form of borrowing.”

The Auditor General said this was an erroneous conclusion because, “under the Government’s financial reporting framework, International Public Sector Accounting Standards, a PPP is a form of borrowing.”

The Auditor General explained further:

The Public Management and Finance Act, among other requirements, sets borrowing limits for the Government.

It requires the Government to obtain approval from the UK’s Secretary of State before acquiring any new loans if it breaches the borrowing limits.

In this case, the Auditor General implied in her report that the Regen public-private partnership, estimated at the time to cost $790 million over 25 years, should have been approved by the UK’s Secretary of State since it was a borrowing arrangement, and it had implications for the Framework for Fiscal Responsibility signed with the UK.

However, as noted by the Auditor General, the arrangement was not recorded as borrowing, and therefore, approval was not sought from the UK’s Secretary of State in line with the Framework for Fiscal Responsibility.

Exacerbating issues with the Framework for Fiscal Responsibility, the Auditor General said:

Core government had sufficient assets to cover liabilities, but this did not include all liabilities, as the reported liabilities did not include the full liability for retirement benefits.

If the Government included that liability, its net worth would be negative.

Both of these diversions from what the Auditor General suggested otherwise as a proper accounting approach means that the Government’s statement of financial position for the relevant periods may be overstated by at least two billion dollars, at least in the case of liabilities for retirement benefits.

The financial issues raised by the Auditor General worsened when she noted that the Government “could have saved over $200 million by funding Regen conventionally” rather than using a public-private partnership.

However, as the Auditor General explained, the conventional funding route may not have been utilised by the Government since “The Outline Business Case stated that the Government could not use conventional borrowing to fund a major capital project” due to “borrowing restrictions.”

The Auditor General continued:

This error meant that a proper appraisal of a PPP against a conventionally funded alternative was not carried out, and the options analysis was skewed towards a PPP.

The OBC did not demonstrate that a PPP was the best financing option.

Value for money

Staying on the topic of financing, the Auditor General explained that the Government was paying the Contractor “an internal rate of return of 9.4 per cent, 6.15 per cent higher than the cost of Government borrowing.”

The Auditor General added:

Small changes to the cost of capital can have a significant impact on costs.

As an illustration, the Government would pay $95 million in interest if it borrowed $206 million (the estimated construction cost of the regen facility) at an interest rate of 3.25 per cent over 25 years.

At an interest rate of 9.4 per cent, the interest paid over 25 years would triple, to $331 million, an increase of $236 million.

The Auditor General concluded: “Therefore, an updated value for money assessment may have shown that conventional funding or borrowing would provide better value for money than the PPP.”

Other concerns and risks

In addition to the value-for-money assessment, the Auditor General analysed the risks taken on by the Government under the public-private partnership.

The Auditor General said:

In March 2021, the Government’s legal advisor prepared a high-level summary of the main points of the Regen contract, ISWMS Project: High Level Project Agreement Summary (the Legal Summary).

The Legal Summary includes, among other information, the allocation of risks between the Government and the Contractor based on the contract.

From our review of the Legal Summary, we found that, overall, the Government appears to bear most of Regen’s risks. This significantly weakens one of the main benefits of a PPP.

In addition to the risks borne by the Government under the arrangement, the Auditor General explained:

The project has experienced a protracted procurement process.

The Government selected Waste Solutions Cayman Ltd. (the “Contractor”) as Regen’s preferred bidder in September 2017.

However, it took almost four years before the Government signed a contract with the Contractor in March 2021.

During this period the consortium members changed without due diligence checks, the estimated waste tonnage increased, the construction cost and the cost to the public purse increased significantly, and most of the risks transferred back the Government.

While not mentioned by the Auditor General as an issue, such a failure to complete due diligence checks could also be a concern from the standpoint that the Government is expected to have high standards in this area to reflect its approach within the strict anti-money laundering regime in the Cayman Islands which requires thorough checks to prevent the proliferation of terrorist financing and money laundering.

Final questions

The final question raised by the Auditor General was a Land Transaction Agreement signed in October 2020 with Dart Enterprises Ltd., which is a separate agreement from Regen.

The Auditor General explained that “The agreement’s purpose was to facilitate the exchange of land between the Government and Dart Enterprises Ltd so that the Government and the Contractor could site Regen at their preferred location.”

Concerning this, the Auditor General said:

The Land Transaction Agreement is independent of the Regen contract.

In other words, even if the Government and the Contractor do not achieve financial close, the land transfers agreed under the Land Transaction Agreement will still happen.

The Auditor General continued:

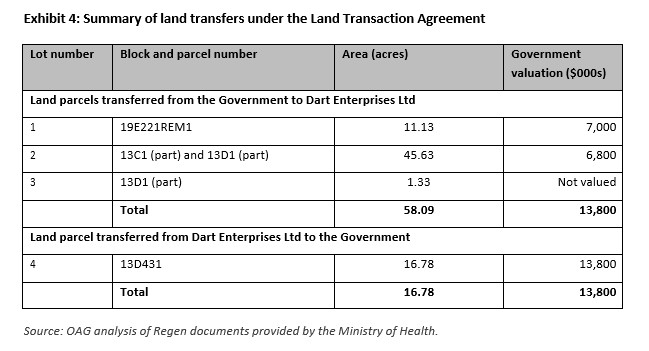

Under the Land Transaction Agreement, the Government will transfer 58 acres of land to Dart Enterprises Ltd and received 17 acres in return.

Neither party will pay any additional money. Exhibit 4 shows a summary of the land transfers under the Land Transaction Agreement.

The Auditor General elucidated:

The Government agreed to transfer Lot 2, the current location of the George Town landfill, to Dart Enterprises Ltd. It is not clear if the Government’s $6.8 million valuation incorporated the ongoing remediation or the Government’s long-term environmental liability for the Lot, that is:

As of August 2021, the Government’s technical advisor estimated that the Government had spent approximately $26 million remediating Lot 2. The Contractor is remediating Lot 2 under a separate contract with the Government.

Under the Land Transaction Agreement, the Government will retain the historical environmental liability of waste from the landfill at Parcel 2. The Government has not quantified the estimated future environmental liability.

She added:

The Land Transaction Agreement requires the Government to transfer Lot 3 to the Cayman Rugby Club as part of a separate contract between Dart Enterprises Ltd and the Cayman Rugby Club. However, it appears that the Government valued the Lot at $0.

The Government’s financial advisor carried out a value for money analysis of the land transfer based on the Government’s valuations and concluded that the land transfer was value for money. However, the financial advisor’s analysis did not consider the valuation of Lot 3.

Summary

Concluding her report, the Auditor General said:

At the time of our review, the contracting parties have not yet finalised some key documents, i.e. the Payment Mechanism and the Performance Measurement Framework. These need to be completed as soon as possible and to the best advantage of the Government.

The Government did not prepare a Final Business Case to reassess the value for money prior to signing the contract in March 2021. This is extremely disappointing. I previously reported in 2017 and in 2020, in the case of the airport redevelopment project, that the lack of Final Business Cases for major capital was a significant gap in the accountability process. In my view the project will not provide value for money.

Based on the Auditor General’s report, which appears to be confined to the period under her review to 2021, members of the public may be curious to know why the Government took the approach described by the Auditor General for the Regen project. They may also ponder why the Regen project was seemingly being pushed through given all of the issues raised by the Auditor General, which, presumably, were discussed with the relevant parties in Government at the relevant time.