Hailey Welch, the “Hawk Tuah Girl" (image source: X)

|

Getting your Trinity Audio player ready...

|

By Alric Lindsay

According to a lawsuit filed on December 19, 2024, with the United States District Court For The Eastern District Of New York filed, several parties sued Alex Larson Schultz, Overhere Limited, Clinton So, and Tuah The Moon Foundation, a Cayman Islands entity according to records obtained from the Registrar of Companies in the Cayman Islands. The claim alleges that one or more of these parties promoted, issued, and sold to the public the Hawk Tuah cryptocurrency meme-coin, known as the “$HAWK” token (the “Token” or “$HAWK”) without proper registration under the Securities Act of 1933 of the United States. Allegedly, one or more parties collaborated with Hailey Welch, a prominent social media personality known as the “Hawk Tuah Girl, to help market the Token, which reportedly surged to $491 million upon launch and plummeted by over 90% shortly thereafter. The parties wish to be repaid for their investments.

Background

According to the claim, the parties “leveraged the extensive social media following of Hailey Welch, a prominent social media personality known as the “Hawk Tuah Girl,” to market the Token as a groundbreaking cryptocurrency project.”

The claim added:

The Token was offered… in collaboration with overHere, a Web3 launchpad platform.

…promotional efforts included posts highlighting the Token’s groundbreaking nature, inclusivity, and roadmap for adoption.

Defendants leveraged Welch’s celebrity status and connections to enhance the Token’s credibility and appeal, including discussing the $HAWK project during Welch’s podcasts featuring notable guests.

The claim continued:

The pre-launch marketing for $HAWK framed the Token as more than a speculative asset, portraying it as a cultural movement with significant growth potential. Welch’s involvement and her reputation as a trusted public figure signaled to her followers and potential investors that the project was poised for success, fostering an expectation of profits based on her efforts.

The $HAWK token launched on the Solana blockchain. The launch had rapid growth in trading activity and market capitalization. However, the Token’s value experienced significant volatility, losing a substantial portion of its value in hours. The Token launched with a market capitalization of $16.69 million. Within hours, the token’s market value surged to $491 million. However, shortly after that, it plummeted more than 90%.

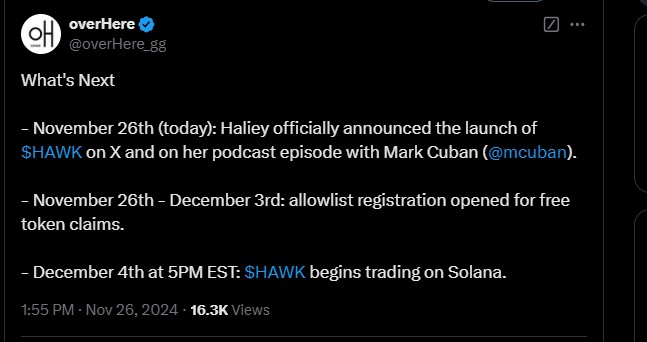

Regarding the timeline for the Token launch and commencement of trading on Solana, overHere tweeted the below message on X (formerly Twitter):

Welch also posted on her X page offering free Hawk meme-coins:

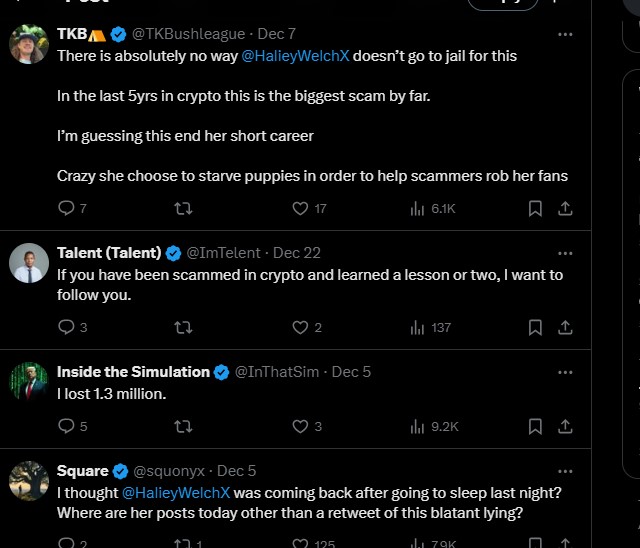

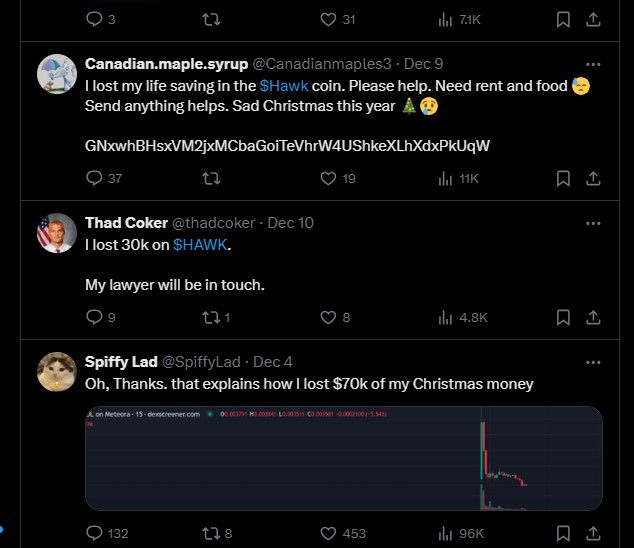

As explained above, shortly after the market value approached $500 million, it collapsed, causing alarm by several persons on X.

Some of the comments were as follows:

Regarding the scam allegations on X, Voidzilla questioned where money from the 17% presale went and asked for explanations as to whether the Token offering was a rug pull. Voidzilla also referenced a Cayman entity.

Concerning the alleged involvement of a Cayman entity, the lawsuit filed with the United States District Court For The Eastern District Of New York said:

Defendant So also explained that the team at overHere attempted to skirt the American securities laws. The project sold an initial allocation of 17% of the Tokens to a select group of individuals. As Defendant So explained, they were advised by lawyers that they should construct the Tuah Foundation as an off-shore entity and sell that 17% through that entity:

We heard the request for us to do this in a public matter. And I think that we having consulted with lawyers, I guess the legal opinion was that in order to protect Haley and mitigate any considerations around potentially being deemed to have sold unregulated securities to Americans, that it should be done by SAFT agreements that would be by this legal structure that we were advised to set up in, I believe it was Cayman or BVI. And we tried to essentially have that as 5k checks and scale that. Ultimately, that was kind of like quite difficult.

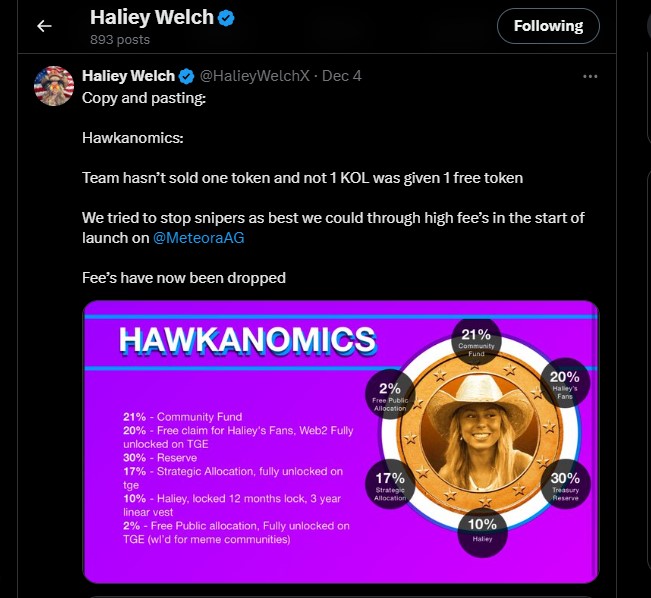

Attempting to explain what occurred on the Token launch, Welch copied and pasted the following on X:

Welch also stressed that her team is taking complaints seriously, posting the following:

Stakeholders now await the outcome of the Securities & Exchange Commission case and any action that the Cayman authorities may contemplate.

Note to readers:

For more on the lawsuit outlining the allegations, the case citation is Albouni et al v. Schultz et al, Docket No. 1:24-cv-08650 (E.D.N.Y. Dec 19, 2024).