By Alric Lindsay

According to the Urban Institute, “The number of people experiencing homelessness has hit a record high, more than half of renters are cost-burdened, and mortgage interest rates are at their highest since 2000—housing in the United States has reached a crisis point.” Some Caymanians and other residents are also at a crisis point, burdened with high rent or mortgage payments and living at or near the financial edge or homeless. To help address these issues, Cayman policymakers ought to consider whether it is appropriate to pass or amend legislation to limit rental price hikes and regulate mortgage interest rates.

Reports confirm higher rental rates.

For those who seek the facts about ongoing increases in rental costs, the quarterly consumer price index published by the Economics & Statistics Office is a credible source of information.

For example, the quarterly consumer price index changes from December 2023 to March 2024 reflect an increase in the inflation index for the housing and utilities sectors.

The quarterly publication explained, “This upward movement was mainly caused by the 2.7 percent increase in actual rentals paid by tenants.”

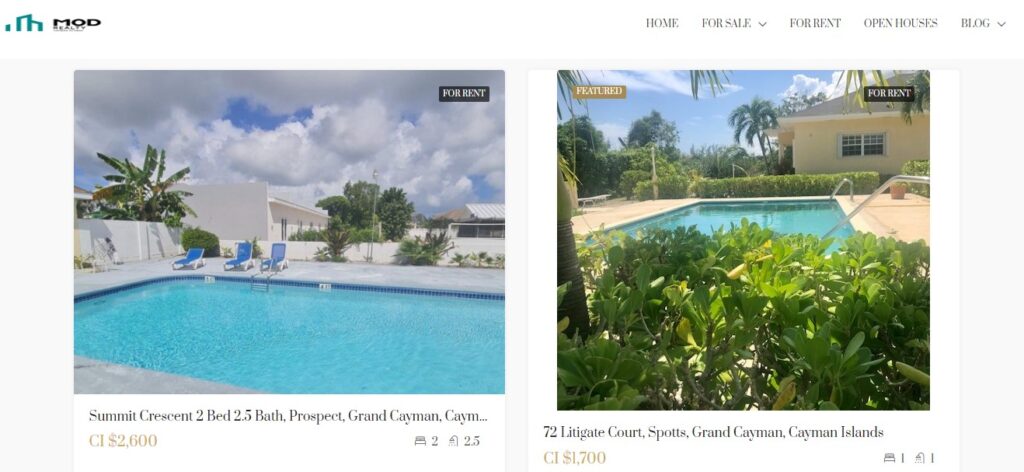

Evidence of rental prices can also be seen in online ads by realtors and landlords.

One ad shown by Mod Realty, a well-known Caymanian realtor, shows one-bedroom apartments for $1,700 and two-bedroom apartments ranging from $2,600 to $5,500, depending on the property location.

Another realtor, Williams2, shows high-end properties for as much as $30,000 monthly.

Looking at mortgage interest rates

Persons who are not renting but instead have variable-interest mortgages have also experienced several interest rate increases over the past year. This is mainly due to the US Federal Reserve’s hikes last year.

As long as the US Federal Reserve maintains its “higher interest rates for longer” stance, local banks that follow the US Federal Reserve’s position will continue to keep their interest rates as is. As indicated in the US Federal Reserve meeting minutes, this will prolong the struggle experienced by lower-income households.

This is especially true for households earning $3,000 or less per month and where rent or mortgage payments comprise over 50% of their monthly income (this is before considering $600 in utility bills or $1,500 in private school fees).

Making the struggle worse is that when hard times hit and parties fall short of mortgage payments, local banks can pursue homeowners in court. Some banks go further and publish the details of the person who defaulted on payments in the Cayman Islands Gazette. In both cases, the circumstances may be stressful for the persons involved.

Resolutions

To lessen the burden of high rental or mortgage payments, Cayman policymakers could consider some of the approaches announced by US President Biden on July 16, 2024.

A fact sheet accompanying Biden’s statement said, “Rent is too high and buying a home is out of reach for too many working families and young Americans, after decades of failure to build enough homes.”

Based on the fact sheet, part of Biden’s proposal is to limit landlord rent increases to 5%.

If the US Congress agrees to Biden’s proposal, “This would apply to landlords with over 50 units in their portfolio, covering more than 20 million units across the country.”

Cayman policymakers could do something similar and amend or introduce legislation, applying it to landlords with more than 10 units.

However, Cayman policymakers must be thoughtful, as the measure cannot have a one-way impact.

That is, landlords must be offered incentives, too (this is especially the case where landlords have loans to pay on the properties they are renting out, and those loans are subject to increases in variable interest rates).

Some of the incentives that could be offered to affected landlords may include:

- Offering low interest rates from government lending entities or credit unions to these landlords who have loans for the properties being rented or are seeking financing to make improvements on rental properties.

- Fast-tracking permits and approvals for these landlords who are seeking to make renovations or new builds

- Giving these landlords priority when the Government is seeking to place clients into rental housing and the Government is guaranteeing rental payments, provided that the Government pays on a timely basis and the Government agrees to fully compensate landlords for any damage caused to the property by the referred tenants.

In addition to addressing rental rate caps via legislation, Cayman policymakers may consider whether it is appropriate to regulate interest rates. Alternatives include requiring banks to give three months’ notice before effecting any increases or giving the Cayman regulator the power to issue directives for interest rate caps which do not materially impair bank earnings.

Consequences of taking no action

If no action is taken or no resolutions are provided to Caymanians and other residents, they will continue suffering.

When this suffering turns into frustration, voters will likely protest the Government or individual MPs who have taken no action.

Voters’ sentiments will then likely be reflected in their votes at the next election.